You know that sinking feeling you get when you look at the SLP chart lately? That lead weight at the pit of your stomach that feels like it might overwhelm you?

Well we’re here to help. We can’t pump the price…but we can give you some insight on how SLP works and what to do when it falls (or, preferably, before it falls next time).

SLP is part of the larger Axie Infinity economy. So the reason that it moves up or down is always the same: supply and demand.

Jump to:

Why is SLP Dropping?

SLP is dropping because of an imbalance in the supply vs. demand for the token. That’s sort of obvious but below you can see exactly how that’s happening.

The graphic below shows the game factors that influence supply and demand. The supply comes from battle earnings, this is how new SLP is minted (created).

Here’s a handy graphic we found on Twitter that shows one perspective on the boom and bust cycle of SLP:

That take might be a little rosy, as it gives an example of a $1 SLP price. The price of SLP has never hit $0.40, never mind a dollar.

The demand for SLP comes from breeding. It costs SLP to breed and that’s the main way that SLP gets burned (taken out of circulation).

The problem that the developers at SkyMavis face is that a lot more SLP is created through battles than is destroyed through breeding.

The top graph below is an SLP price action chart from CoinGecko and you can see the good ol’ days back in July of this year when SLP was hitting all-time highs.

The bottom graph is from AxieWorld.com and shows the minting and burning rates of SLP. I’ve circled in red the same timeframe from July and you can see that there was much more parity between minting and burning around that time. SLP was flowing into and out of the economy at similar rates.

Since July, the minting rate has been steadily marching upwards whereas the burning rate has remained relatively constant. In other words, like many currencies (including the US dollar), SLP is experiencing inflation.

Will SkyMavis Fix It?

Don’t think the game’s creators don’t care about the price of SLP. Over time, cratering prices could destroy the game so they are on the case.

The developers of the game have already made some fixes designed to address SLP inflation. Every player will have already noticed these changes.

2 Types of Fixes for SLP Inflation

There are two ways to address SLP inflation: lowering supply or increasing demand. Most of the fixes so far have been targeting the supply side, lowering the amount of SLP minted each day.

Remember when the daily rewards got cut in half? That lowered the SLP minted each day.

How about when players below 800 MMR stopped earning SLP altogether? Again, that lowered the SLP minted.

Unfortunately, these fixes were not enough because the trend lines remain the same. In fact, you barely notice the effects on the SLP price chart when viewing the data for all time (as in the chart above from CoinGecko).

Will SLP Go Back Up?

There is hope. Most recently, there was a fix deployed to increase demand for SLP.

Players may not have noticed this change at all but breeders definitely did.

On December 8th, SkyMavis announced big changes to the breeding fees. The AXS cost was cut in half and the SLP costs were tripled.

This change addresses the demand for SLP and should have a significant impact over time. That last bit, over time, is critical. It takes time for the economy to respond to changes like that.

Will This Change Hurt AXS?

A little. But AXS has some key advantages that SLP lacks.

You can see that the price of AXS did decline right around the time of the breeding fee update announcement:

Why AXS Holds Value Better than SLP

AXS has two key advantages over SLP. One is that there is a total supply cap. Below you can see the circulating supply vs. the max supply (from Crypto.com):

So while only about 23% of the max supply is in circulation, there will never be more than 270 million AXS in existence. SLP has no such cap, it is theoretically infinite in supply. Here’s the same info from Crypto.com on SLP:

Not only is it uncapped, but there’s 3.21 billion SLP in circulation. This explains why AXS is worth roughly $100 while SLP is worth roughly 3 cents as of this writing.

The second key advantage AXS has is retail demand. That is, crypto investors buy and hold AXS hoping the price will go up. This creates a deep well of demand that SLP lacks.

The only people who buy SLP as an investment are people who don’t do their research on what it is and how it functions (i.e., suckers). It’s a cliche at this point but if you’re investing in crypto, do your own research.

As a result, the AXS price chart above looks relatively healthy despite the recent dip. It’s obviously going up over time in a general sense.

Contrast that with the SLP price chart:

This chart looks like it’s struggling to bounce off the floor, and may be coming to rest on the floor…

What Should I Do Now?

So this is a bunch of super useful background info (I’ll try not to pat myself on the back too hard) but you’re probably wondering what you should actually DO now.

The answer is that SLP is a currency, so you should behave like an investor.

Disclaimer: This site does not dispense investment advice. Investing entails risk and investing in cryptocurrencies entails incredible risks. Nothing on this site is to be seen as investment advice in any way.

Investors may speculate, but they also diversify and seek to minimize volatility in the assets they want to hold onto over time.

YOUR Key Advantage

Your key advantage as a player (and even more so if you’re a scholar) is that you didn’t invest any money in the gameplay. Even if you own your own team, the Axies are NFTs that can be sold on the marketplace so your SLP earned is above and beyond the value of your team.

What you have invested is your time, and you got entertainment value from the gameplay. Until recently, virtually no one ever got paid to play video games and the entertainment value was the whole payoff.

So relax…and start looking at the ways you can secure the value that you have created via SLP.

Trade Up the Value Ladder (for free)

SkyMavis has given players an incredible gift in the form of the Katana exchange. You can now make swaps between several tokens for free within Katana.

The gas fees on a normal swap that you might do in MetaMask can eat up most of your profits, so this is a huge advantage for Axie players.

As you can see above, from SLP you can swap into WETH, AXS, or USDC. While that’s not a huge array of options, it basically covers all the bases.

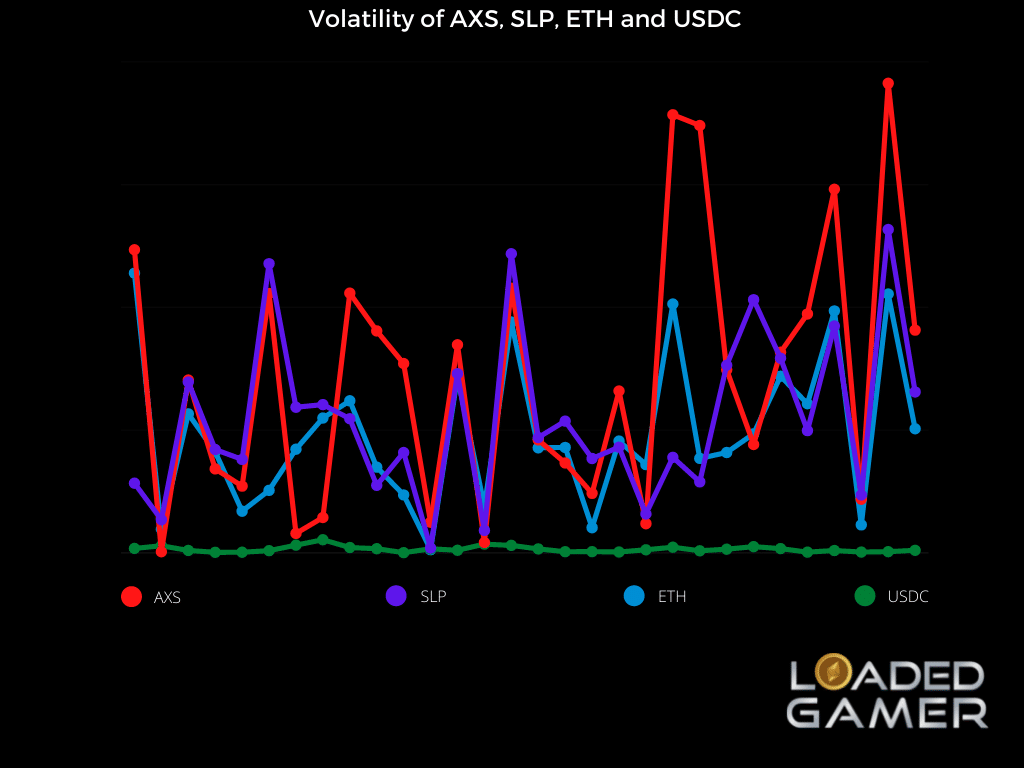

You can think of each of these options in terms of volatility and upside, i.e., how safe they are and how likely they are to go up in the future (and by how much). From this point forward, I’m not telling you what to do, I’m telling you what I do and how I think about these options.

SLP

SLP has a lot of volatility but as we discussed above, it has no max cap so the chances of it going to the moon are roughly zero. That means the upside is very limited and the volatility is high. In short, it’s a crappy place to keep your money.

Therefore, my goal with SLP is to get out of it as quickly as possible, so long as the price is reasonable. What “reasonable” means to each person will be different. I don’t use SLP earnings to put food on the table, so I have a pretty long horizon, I can wait for prices to spike and then sell some SLP.

Often when I see a token like AXS spike in price, my inclination is to hold onto it in the hopes that it multiplies further. When I see SLP spike in price, my immediate reaction is to sell.

That recently happened when I noticed SLP had gotten to $0.12. I didn’t start thinking “maybe it will go back to $0.20.” I instead just took as much off the table as I could and I’m pretty happy with that decision now.

AXS

The next step up the ladder in my view is AXS. AXS has a much smaller market cap than ETH or USDC and as such can be viewed as a much riskier bet. It has increased enormously this year, producing a mind-boggling rate of return. However, there’s certainly no guarantee it will continue to do that. Buying AXS is effectively a bet on the future value of the Axie Infinity as a whole. I do hold AXS and have profited substantially from the rise, but I hold far, far less of it than ETH and USD.

WETH

Ronin wrapped Ethereum or WETH, has the same exact characteristics as ETH. It is second only to Bitcoin in its market cap and a huge number of projects in the crypto world are based on ETH. As crypto goes, I personally consider it very unlikely to fail.

It’s certainly far more volatile than USDC, but it also could potentially double, triple or more in price in the future. So I personally consider WETH to be a solid place to store value. It is relatively unlikely to drop to the floor and still has the upside potential that USDC lacks.

USDC

USDC is a stable coin pegged to the US dollar. So it will behave exactly like the dollar, just like WETH mimics ETH. This is a pro and a con.

The pro is that it is incredibly stable, the volatility is extremely low. The con is that it also suffers from inflation so you can reliably expect it to decline in purchasing power year over year.

However, that happens slowly enough that it’s only a concern if you hold it for years rather than spending or investing it.

How I Move Funds Up the Ladder

What I personally do with the ladder outlined above is that I allocate it according to my own risk tolerances (as should you).

I always move out of SLP at the first opportunity, which for me usually means when it crosses $0.10. I move a small portion into AXS as a bet on the future of the game and the rest into WETH.

I have a long time horizon and an above-average tolerance for risk, so I like to just park funds in WETH. It could potentially go up significantly, as opposed to USDC which is virtually guaranteed to slowly decline in buying power.

I also like to have WETH available to purchase new Axies on the marketplace so there’s a convenience factor as well.

Take the Long View

I find that it’s easier to make sound decisions about money when you’re taking a longer-term view. The best thing you can do for your own sanity is often just to zoom out and look at the big picture.

You’re living in an incredible time in human history, one where playing video games for profit just became a possibility for millions of people. So just make sure to properly value your time, and create hard rules for yourself about when you take profits and where you move those funds. WAGMI!

Related Posts

Troubleshooting Performance & Technical Issues in Axie Infinity

Have you experienced issues and errors when playing Axie Infinity? Most of the time, a quick restart of the game

How to Make a Resume for Axie Infinity

You’ve probably seen quite a few of these resumes for Axie Infinity scattered across the internet. Forums, Facebook groups, and

How to Use a Hardware Wallet with Axie Infinity

So, you’re trying to up your crypto security huh? A wise choice! Dealing with cryptocurrency can be a tedious, albeit